The DIY Credit Repair & Arbitration Starter Kit - Just $47

Start with our introductory DIY Credit Repair and Arbitration guide to transform your financial health.

Mastering Credit Repair With Arbitration Strategies

Kickstart your journey to financial freedom from Day 1 by leveraging our proven strategies—The Credit Repair DIY and Arbitration Starter Kit.

The book can provide detailed guidance on using arbitration as a tool to resolve credit disputes outside of the traditional court system.

It educates readers on key consumer protection laws, such as the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA).

Beyond basic credit repair advice, the book delves into advanced strategies that involve legal tactics and arbitration to remove negative items from credit reports. This can be particularly beneficial for those who have complex cases or have not succeeded with standard dispute methods.

If you have any questions, submit form below.

How DIY Credit Repair and Arbitration Simplify the Path to Financial Recovery

💸Empowerment Through Knowledge: DIY credit repair through arbitration equips you with the knowledge and resources to understand your credit report and the factors affecting your score.

💸Cost Effectiveness: Arbitration is a faster, simpler, and more affordable alternative to traditional litigation, offering streamlined procedures, lower legal fees, and quicker resolutions for efficient dispute management.

💸 Faster Dispute Resolution: Arbitration streamlines the dispute resolution process, offering a quicker alternative to traditional litigation or extended negotiations with credit bureaus.

💸 Control and Customization: Taking charge of your own credit repair and using arbitration provides greater control over the dispute process. You can customize your approach to address specific issues on your credit report, ensuring your actions are targeted and effective.

Who Benefits From DIY Credit Repair and Arbitration?

First-time Homebuyers

Recent College Graduates

Small Business Owners

Victims of Identity Theft

Divorcees

Military Veterans

Job Seekers

Retirees

Immigrants

Individuals Denied Loans

Real Estate Investors

Debt-Heavy Consumers

Legal Guardians

AND ... even MORE!

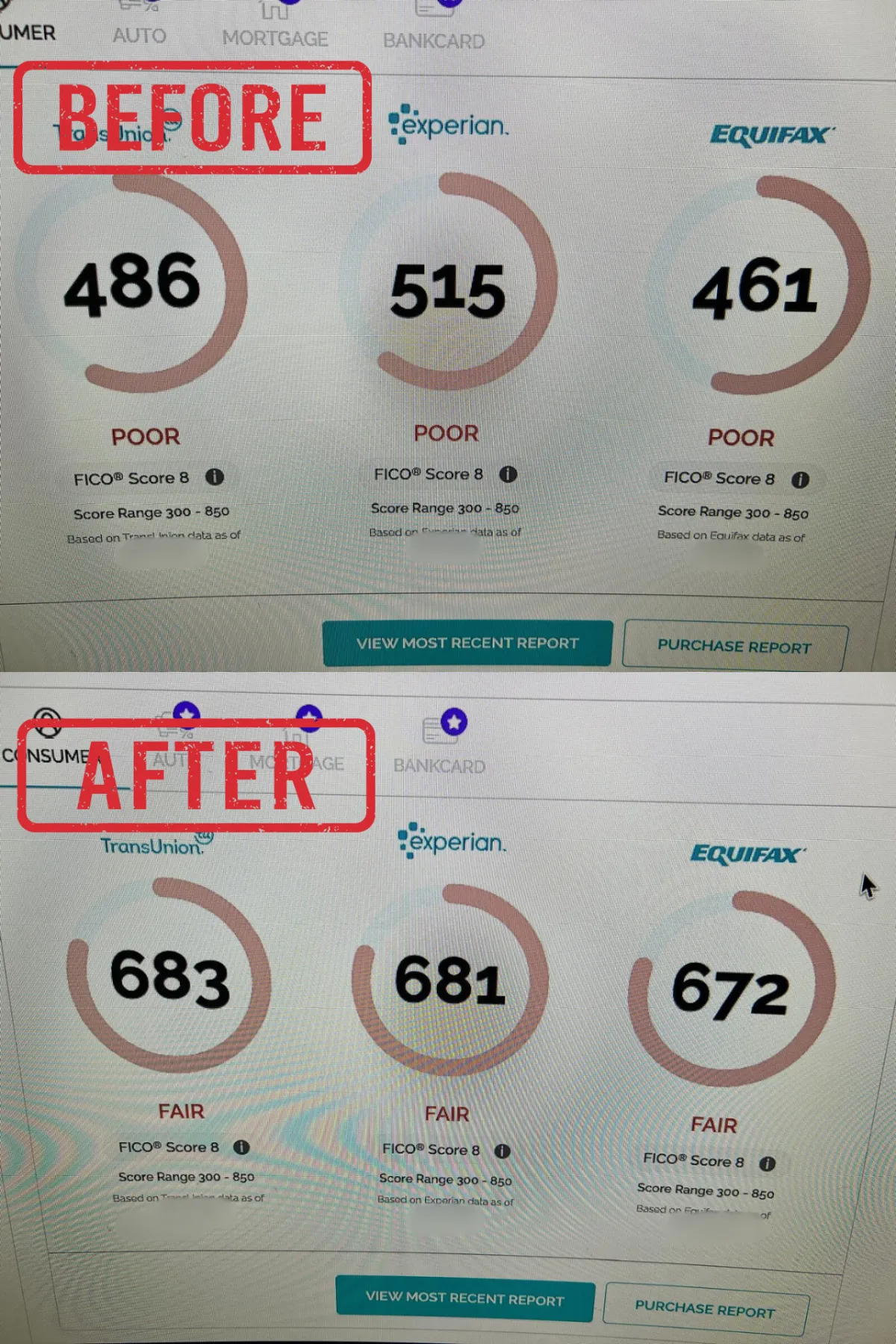

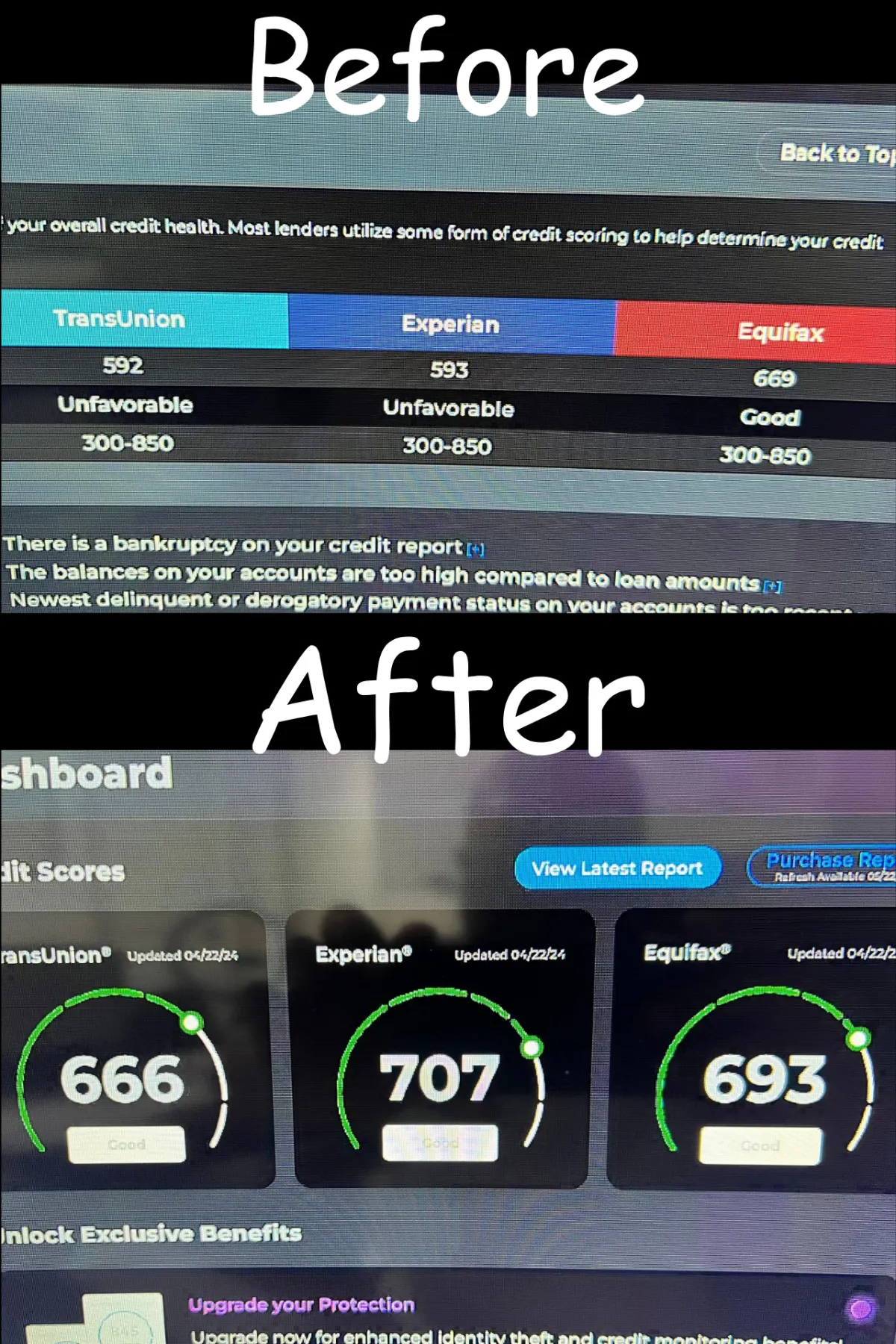

Credit Score Transformation: Before and After Using DIY Credit Repair and Arbitration

In The First 30 Days

Discover How DIY Credit Repair and Arbitration Are Delivering Real Results

From a 638 to soaring scores in just months! Don't just take our word for it—listen to real success stories. Connect with Hassan today and make your credit repair journey as real as it gets!

Transform your credit scores! Just like Tiffany, who cleared $25,000 from her report in months, you too can experience real, rapid credit improvement. Don’t wait—trust us to navigate your credit repair journey.

Boost your credit scores. Experience quick, dependable, and honest credit repair and arbitration services. Don't wait, start your journey to financial freedom today!

In a matter of weeks, watch your scores climb remove negative items and optimize your credit. From repos to identity theft, clear it up! Get your copy today and see your credit score soar—just like our recent client who enjoyed a major credit boost up to 691. Tap in now for clean credit, fast!

Just one month into our program, and our client's collection woes are history—boosting scores from the low 500s to a promising new start. Ready to build a solid credit foundation?

Elevate your credit ASAP!

Just one month into our program, and our client's collection woes are history—boosting scores from the low 500s to a promising new start. Ready to build a solid credit foundation?

Let's elevate your financial future together!

Here's How Embracing DIY Credit Repair And Arbitration Transformed My Financial Outlook Swiftly

Like many of you, my path to financial clarity was filled with personal challenges and early missteps that led to significant credit issues during my college years.

Despite several temporary solutions, my credit score continually suffered due to poor financial habits.

My breakthrough came when I discovered a critical article in 2006, revealing that 79% of credit reports contain errors.

This introduced me to the Fair Credit Reporting Act, a crucial tool that enabled me to effectively manage and dispute inaccuracies in my credit report, leading to real improvements.

By 2011, I had not only rectified my credit issues but had also raised my score to 720.

This personal victory inspired me to establish Credit Medics Rx to offer support to both high net-worth and low-income individuals aiming for better credit and financial stability.

My mission evolved from personal recovery to a professional commitment to empower others.

Each corrected credit report and improved score is more than just a number—it signifies lives rebuilt, homes secured, and dreams realized.

Today, I confidently manage over 100+ successful arbitrations and credit disputes monthly.

This system, refined over years of relentless dedication and learning, is designed to provide the best outcomes possible.

I've invested years into perfecting credit repair strategies, mastering arbitration techniques, and understanding financial legal frameworks.

Now, I’m sharing these proven methods so you can reclaim your financial freedom too.

See the tangible proof right from my own journey—transform your financial story starting today.

Here's how to get started with DIY credit repair and arbitration in 3 easy steps today:

STEP 1

Choose Your DIY Credit Repair Strategy: Select from our proven list of DIY credit repair and arbitration tactics that best fit your needs.

STEP 2

Customize Your Dispute Letters: Use our ready-made templates and simply fill in the details relevant to your case. Follow our step-by-step guide to tailor the letters for maximum impact in disputing errors or unfair charges.

STEP 3

Execute Your Strategy: Gather your supporting documents, send out your customized dispute letters, and track your progress. Use our easy follow-up templates to stay consistent and see real results from day one!

Here's what's included in the DIY Credit Repair and Arbitration Starter Kit:

Our Proven List of Effective Credit Repair and Arbitration Strategies: Choose the best tactics, fill in the specifics for your situation, and start seeing results. These strategies are backed by years of experience in successful disputes and credit repair.

Import Our EXACT Dispute Letter Templates: These templates are versatile and proven to work across a variety of credit issues. They come with step-by-step instructions to guide you, ready to send out today.

Copy and Paste Winning Dispute Templates: From our extensive library, select the most effective templates for your case. Just fill in your personal information and specific credit details to launch your credit repair efforts within the next 24 hours.

Fill-In-The-Blank Follow-Up Templates: Accompany your dispute letters with our pre-crafted follow-up templates. These work hand-in-hand to maximize your chances of getting inaccuracies removed and seeing quick improvements in your credit score.

Frequently Asked Questions

What is DIY credit repair and arbitration, and how does it work?

DIY credit repair involves using proven strategies to dispute inaccuracies and errors on your credit report on your own, while arbitration helps resolve disputes with creditors without going to court. You’ll follow step-by-step guides and use templates to handle the process independently.

What’s included in the DIY Credit Repair and Arbitration Starter Kit?

The kit includes a list of proven credit repair strategies, ready-to-use dispute letter templates, follow-up templates, and a guide to arbitration. You’ll also receive additional bonuses to help you navigate the process.

How long does it take to see results with DIY credit repair?

While results can vary depending on the complexity of your credit situation, many people begin to see improvements in their credit score within 30 to 60 days of sending out dispute letters and following up regularly.

Is DIY credit repair legal, and will it impact my credit negatively?

Yes, DIY credit repair is completely legal, and it uses laws like the Fair Credit Reporting Act to your advantage. Properly disputing inaccuracies should not negatively impact your credit score; instead, successful disputes can help improve it.

What types of credit issues can I address with this kit?

The kit can help you tackle a variety of credit issues, including removing collections, charge-offs, late payments, repossessions, and inaccuracies. It also provides strategies for arbitration if you need to negotiate with creditors directly.

What if my disputes are unsuccessful?

If initial disputes are unsuccessful, the kit includes follow-up templates and additional strategies to strengthen your case. You’ll also learn how to escalate disputes using arbitration if necessary, giving you multiple avenues to achieve success.

Can I use this kit for multiple credit reports and disputes?

Absolutely! The templates and strategies are reusable, allowing you to address issues on all major credit reports—TransUnion, Experian, and Equifax—and handle multiple disputes as needed.

Do I need any prior experience or legal knowledge to use this kit effectively?

No prior experience or legal knowledge is necessary. The kit is designed for beginners and provides step-by-step instructions, easy-to-follow templates, and video guidance to ensure that anyone can successfully navigate the DIY credit repair and arbitration process.

Copyright -2025 Credit Medics LLC

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

The results you see are from specific clients. We do not guarantee that you will achieve the same results with your DIY credit repair and arbitration efforts. Your results could be better, worse, or similar. We only guarantee that we will provide you with the tools and strategies to help enhance your credit repair and arbitration outcomes.