Last Chance! Your order is processing. To avoid double charges, do not click the 'back' button. In the meantime, please read the following & select an option below:

I'm Going to Give You $10 OFF So You Can Grab The "Powerful FCRA Credit Repair Letters To Get Deletions" For $17...

Unlock the Power of Proven Dispute Letters to Remove Negative Items from Your Credit Report!

These expertly crafted, legally-backed FCRA dispute templates are your key to faster deletions and a stronger credit score.

Take control of your credit journey today!

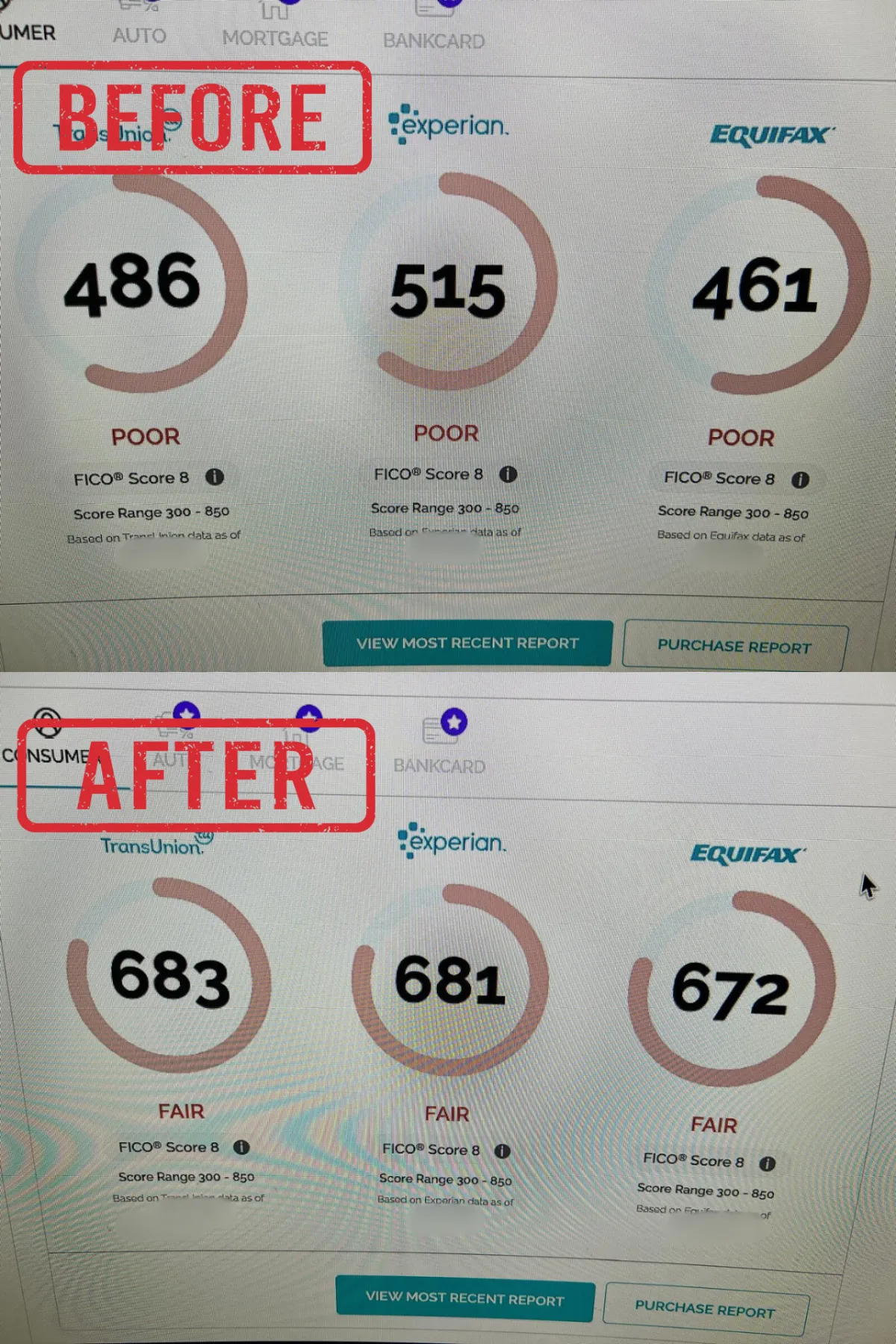

Here's my client before and after credit score.

Then more clients see the good results.

In less than 48 days, this clients credit score went up to almost 700!

Unlock the Full Potential of "Powerful FCRA Credit Repair Letters to Get Deletions"

Proven Tools for Credit Repair Success: This guide includes expertly crafted, legally backed dispute letters specifically designed under the Fair Credit Reporting Act (FCRA) to help you target and remove inaccuracies from your credit report. These are the same templates that credit professionals use to achieve consistent deletions and score improvements.

Achieve a Higher Credit Score, Faster: With targeted dispute letters tailored to various credit issues, you’ll be equipped to address inaccuracies more effectively. These letters are structured to improve your success rate in getting negative items removed, helping you achieve a healthier credit score in less time.

Comprehensive Understanding of Your Legal Rights: Discover the power of the FCRA and learn how to leverage its protections. This guide provides insights into your rights as a consumer, empowering you to take action on errors that may be unfairly damaging your credit profile.

Save Money with Better Loan Terms: A higher credit score can unlock access to better loan terms, credit card interest rates, and refinancing options, translating into substantial savings over time. By actively managing your credit repair, you set yourself up for long-term financial gains.

Step-by-Step Instructions for Each Dispute Letter: Each letter template comes with detailed guidance to help you understand when and how to use it effectively. Whether disputing late payments, collections, or charge-offs, you’ll feel confident following a structured process to achieve results.

Professional Confidence in Every Dispute: Backed by expert knowledge, these letters are crafted to reflect your rights and articulate your case powerfully. You can rest assured that each letter is designed to meet legal standards while making a compelling case for removing negative items.

Safeguard Your Financial Reputation: Take control of how creditors see you by keeping your credit report accurate and free of outdated or erroneous information. These letters enable you to maintain a strong credit profile, crucial for your financial reputation.

Achieve Financial Independence from Credit Repair Services: Rather than relying on costly credit repair companies, you’ll have the tools and knowledge to handle disputes yourself, saving hundreds or even thousands in fees. With this guide, you can effectively manage your credit repair journey on your own terms.

Secure Peace of Mind and Long-Term Stability: Knowing you have the right tools and strategies to address credit inaccuracies provides peace of mind. By improving your credit, you’ll lay a solid foundation for future financial security, from homeownership to business opportunities.

Empower Friends and Family with Your Knowledge: As you become adept at managing your own credit, you’ll also have the resources to help friends and family facing similar credit challenges. This guide allows you to make a positive impact in their lives, helping them achieve better credit and financial opportunities.

One-Click Checkout

Copyright 2025 Credit Medics LLC

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

The results you see are from specific clients. We do not guarantee that you will achieve the same results with your DIY credit repair and arbitration efforts. Your results could be better, worse, or similar. We only guarantee that we will provide you with the tools and strategies to help enhance your credit repair and arbitration outcomes.